There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

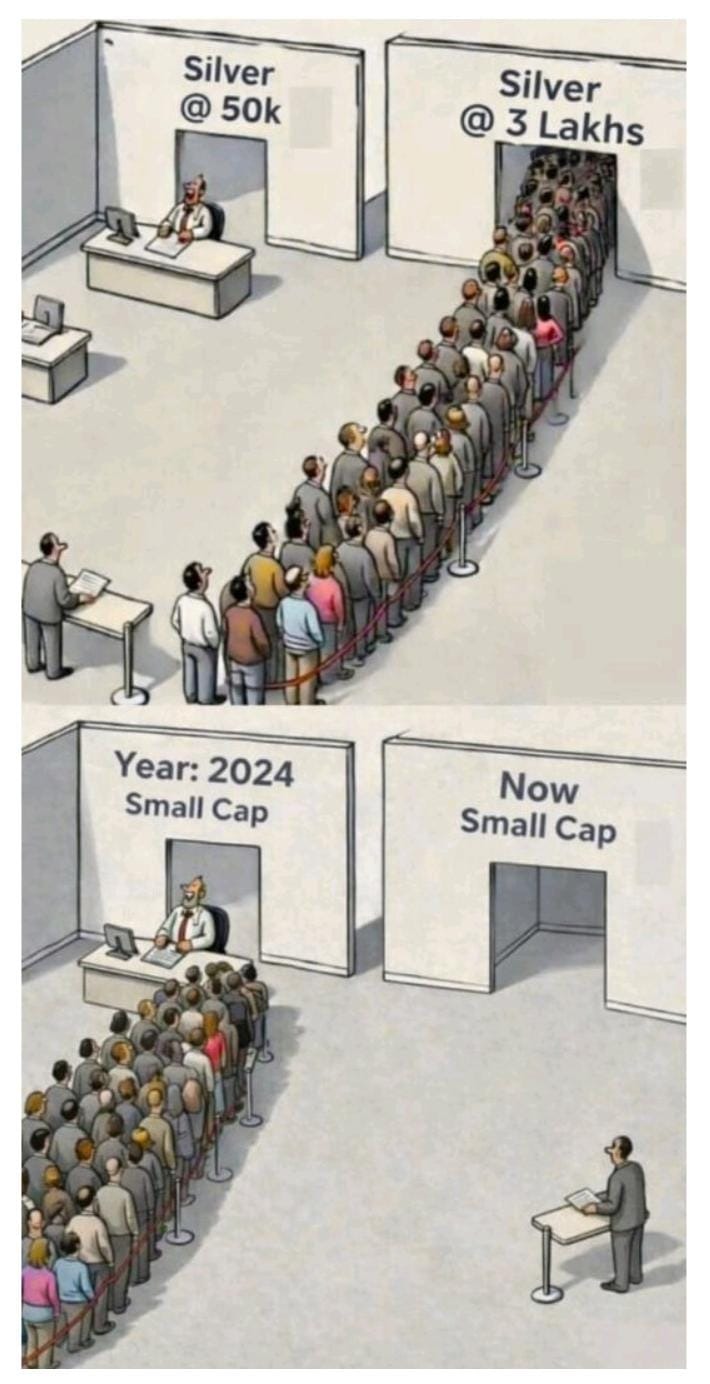

One of the most common investment mistakes isn’t lack of information - it’s recency bias. We assume what’s working now will keep working forever. History tells a different story.

Markets move in cycles. The solution is to stay "Diversified" every time, as nobody knows the market's next move.

Assets that outperform today often cool off tomorrow. Chasing recent winners usually means buying near the top, with limited long-term upside.

Smart investors think differently:

Wealth isn’t built by following the crowd. It’s built by understanding cycles—and letting time do the heavy lifting. Are you investing based on recent performance, or long-term principles?